The Italian Renewable Power Market

The Italian power market will undergo significant changes in the next few years as its fuel mix undergoes a transformation, with more renewables and a decline in coal. Meanwhile, an increasing number of interconnections among Italy and its neighbours means that major structural changes in the German, French, and other markets will have implications for the Italian power sector. But, despite a substantial tightening in the power market in Germany from early next decade as a result of its nuclear and coal closure program, S&P Global Platts Analytics expects Italy to retain its position as the premium market in terms of power prices in Western Europe to 2025, and for prices to rise consistently in real terms between 2020 and 2025. This is partly due to Italy's large gas capacity, which makes its power prices heavily dependent on PSV ("punto di scambio virtuale" or virtual trading point) gas prices, which are also consistently above those of other European hubs. S&P Global Platts Analytics forecasts PSV gas prices to fall from 2018 levels, when they were at about 25€/MWh, until the end of the decade to below 20€/MWh but to recover from 2021 as a reduction in liquefied natural gas (LNG) imports and lower European gas production reduce the competitive pressure on Russian gas.

Coal closures mean that gas will remain the dominant technology in Italy in the foreseeable future. As such, prices are heavily dependent on PSV gas prices. Imported natural gas enters the national network through eight entry points. In 2018, Italy's major suppliers were Russia (41%), Algeria (24%), and Libya (6%), while pipeline imports from northwest Europe and LNG accounted for 11% and 12% of Italian supply, respectively.

Edison SpA's announcement in early March that it would invest in a new 0.8GW combined cycle gas turbines plant at Marghera represents the first large addition to the Italian thermal fleet since 2013. But overall, new additions of large gas capacity to 2025 are expected to be limited, shifting the focus on renewables and imports to balance the system. By 2023, Italian interconnector capacity will expand by 1.2GW with mainland France and 1.0GW with Switzerland, from 3.2GW and 4.2GW today, but increased flows have a limited impact on the robust margins of domestic thermal plants. As a result, Italy is expected to reinforce its position as the premium power market in Europe (even as Germany becomes increasingly tight in the next decade as a result of its coal and nuclear closure programs).

Italian wind and solar capacity are both forecast to more than double by 2030 from 2018 levels, while neighbouring France is also expected to see robust increases. The anticipated growth in renewables to 2030 adds downward pressure on wholesale power market prices, but this will be offset by continued coal and nuclear closures in France, Germany, and elsewhere as well as upside in demand from the electrification of transport, and, to a lesser extent, heating.

Italy has been historically strong in hydro production, which has represented the bulk of renewables production in the country. In 2018, hydro output was 49TWh, which was 9TWh more than reported solar and wind generation combined. However, the potential for growth in hydro capacity--currently at around 12GW for large scale and 22GW in total--is limited, while solar photovoltaic capacity in the country increased rapidly from 3GW in 2010 to approximately 21GW by the start of 2019, and is forecast to increase further to 27GW by 2025. Similarly, wind, whose total installed capacity in 2010 was 6GW, increased to 10.3GW by the start of 2019 and is forecast to increase to 14GW by 2025.

Can Italy Do It Again?

How will Italy reach its ambitious goals to increase renewables in the energy mix by 2030? The country has proposed to increase its solar and wind installed capacity to 50.9GW and 18.4GW by 2030, from 21GW and 11GW as of end-2018, according to the National Energy and Climate Plan the government submitted to the European Commission on Jan. 8, 2019.

This plan would go a long way to meeting the National Energy Strategy (NES) approved in November 2017, with the ambitious goal of increasing the share of energy from renewable sources in gross final consumption to 30% by 2030, from 18.3% in 2017 and 17.5% in 2015.

Italy has a successful track record in achieving renewable targets as its 2020 energy strategy target of 17% of renewables in gross energy consumption was reached in 2014, six years ahead of the deadline, performing better than other EU countries. We note that in 2018 power represented 55% of energy consumption.

The achievement of past targets, however, reflects exceptional growth in renewable investment in Italy, particularly in solar photovoltaics (PV) and onshore wind between 2010 and 2013, boosted by generous subsidies. Feed-in tariffs for solar PV halted in 2013 in Italy, while other renewable sources (mainly onshore wind) continued to be promoted through auctions, the latest of which was in December 2016.

Contracts for Difference May Make A Difference

The country expects to hold seven competitive auctions featuring contracts for difference (CFD) this year through 2021 to promote renewable investments in Italy, which may go some way to helping the country reach its 2030 targets. They include up to 4.8GW in new PV and wind power plants, together with 140MW of hydro, biomass, and geothermoelectric plants, and 490MW repowering investments.

The final version of the decree authorizing the auctions has not yet been approved, and the first auction, which was first to be in October 2018, then on Jan. 31, 2019, has been further delayed. Overall, we expect the Northern League-Five Star Movement coalition government established in June 2018 to continue supporting decarbonization and renewables growth (see "Will The Momentum Build For Green Finance In Italy?" published on Aug. 2, 2018), in line with the content of the coalition government contract. Indeed, the draft Renewables Decree circulated in September 2018 is much the same as the draft prepared by the previous government.

The proposed incentive of the new auctions is a novelty in Italy but largely mirrors the mechanism of CFD already launched in other European countries. A CFD stipulates that the electricity generator will sell energy to the buyer at a fixed price ("strike price") and the parties will exchange the difference between the strike price and market price at contract time. According to the current version of the Renewables Decree, the reference price for the first auction is set at 70€/MWh for solar PV and wind projects, with a 70% maximum discount.

This means that bidders will submit to the Gestore dei Servizi Energetici (GSE), which is the state-owned entity responsible for granting renewable incentives in Italy, their offer expressed as a percentage discount to the reference price. Successful bidders will be selected based on the highest discount and, in case of parity, based on their rating on legal aspects (as stated under European Directive No. 27/2012), followed by their location (for example, plants on dump, mining or contaminated sites will rank first) and, finally, by the earliest date of their offer submission.

Smaller plants with installed capacity of less than 1MW are excluded from the auctions but will also be offered incentives through dedicated registers, to support about 1.49GW of new capacity. These auctions have a higher reference price with a 30% maximum discount (see table 2).

Because the reference price for plants above 1MW is closer to the market price than under previous incentive plans, in our view this reduces the risk that this plan may become unsustainable and require retroactive changes.

In 2014, for example, a retroactive change was introduced (see Decree No. 91/2014, the so-called "Spalma Incentivi") to reduce the amount of subsidies ultimately borne by final consumers. Among three different available options, most Italian PV plants opted for an immediate reduction of the feed-in tariff by 8% over the remaining life of the incentive.

However, the level of unitary feed-in tariff granted to solar PV was significantly higher than the reference price of the envisaged auctions.

Under the upcoming auctions, the projects that are selected will be entitled to receive a certain "strike price" fixed on a nominal basis for 20 years. When the "strike price" is higher than the regional market price, the GSE will pay the project the difference between the "strike price" and the market price. Vice versa, when the regional market price is higher than the "strike price," the project will pay the GSE the difference between market price and the "strike price,"

This means that for the first time, auctions may also generate revenues for the GSE in case future market prices are higher than strike prices. This further reduces the risk of retroactive changes.

From a credit perspective, the CFD mechanism of the proposed auctions removes all project exposure to market risk by ensuring a unitary tariff, which remains flat for 20 years, irrespective of merchant prices. This mechanism reduces potential upside for sponsors but increases the predictability of project cash flows for lenders and, therefore, provides better visibility on debt-service coverage ratios. However, as renewable projects are starting to come online fully exposed to merchant risk, are CFD the most cost-effective way to stimulate renewable investments, while keeping the tax burden at a minimum?

How Can Italy Meet The 2030 Targets?

The size of the expected auctions (overall slightly less than 7GW of installed capacity) is lower than the ambitious goal of the proposed National Energy and Climate Plan, which aims at increasing solar PV and wind installed capacity by about 37.3 GW by 2030 in total.

Projects are not selected during the auctions will not have access to potential subsidies, therefore remaining exposed to merchant risk. However, the absence of subsidies per se is not obstructing investments in the sector. Capital investment has fallen dramatically over the past decade, and there is now greater transparency about technology performance (see "Shining Light On The Key Rating Assumptions For Our Solar Photovoltaic Project Portfolio," published on April 10, 2018, on the key rating assumptions for our solar PV project portfolio). Therefore, we understand that renewables can be competitive without subsidies under certain conditions.

However, the key concern for financing new renewable assets in the absence of public support is the exposure to the volatility of merchant prices, which makes the predictability of cash flow relatively uncertain in the long term.

Long-term price purchase agreements (PPAs) are an alternative to public subsidies as they set fixed prices and reduce uncertainty about market volatility. They typically represent bilateral sale agreements where the off-taker (purchaser), which can be a corporate entity, typically a utility, or simply a trader, buys future energy production at a certain price from the producer.

In terms of credit risk, reliance on long-term PPAs exposes the project to the creditworthiness of the third-party off-taker, unless mitigated by other public or private entities.

Unlike in the U.S., Europe has not developed a market of long-term PPAs yet, but some transactions are starting to emerge--and Italy is not an exception.

The draft Renewables Decree for the upcoming auctions fails to provide some immediate measures to facilitate the development of a PPA market in Italy, despite the announced intention of creating a platform to negotiate long-term energy contracts.

We think utilities with a large customer base, such as Enel SpA, might be more willing to increase their exposure to merchant risk. Enel is an example of a utilities giant that can offset merchant risk, in our view, through its vertical integration, large customer base, and the nature of its generation mix, given that a large portion still comes from conventional plants.

What Are The Peculiarities Of The Italian Renewable Space?

One of the complexities of the Italian market is the presence of six different regional markets were the energy is traded (Northern Italy, Center North, Center South, South, Sicily, and Sardinia). This leads to a material difference in energy prices per region, which in some cases can reach 10€/MWh. And, the smaller the market, the more difficult to forecast longer-term prices.

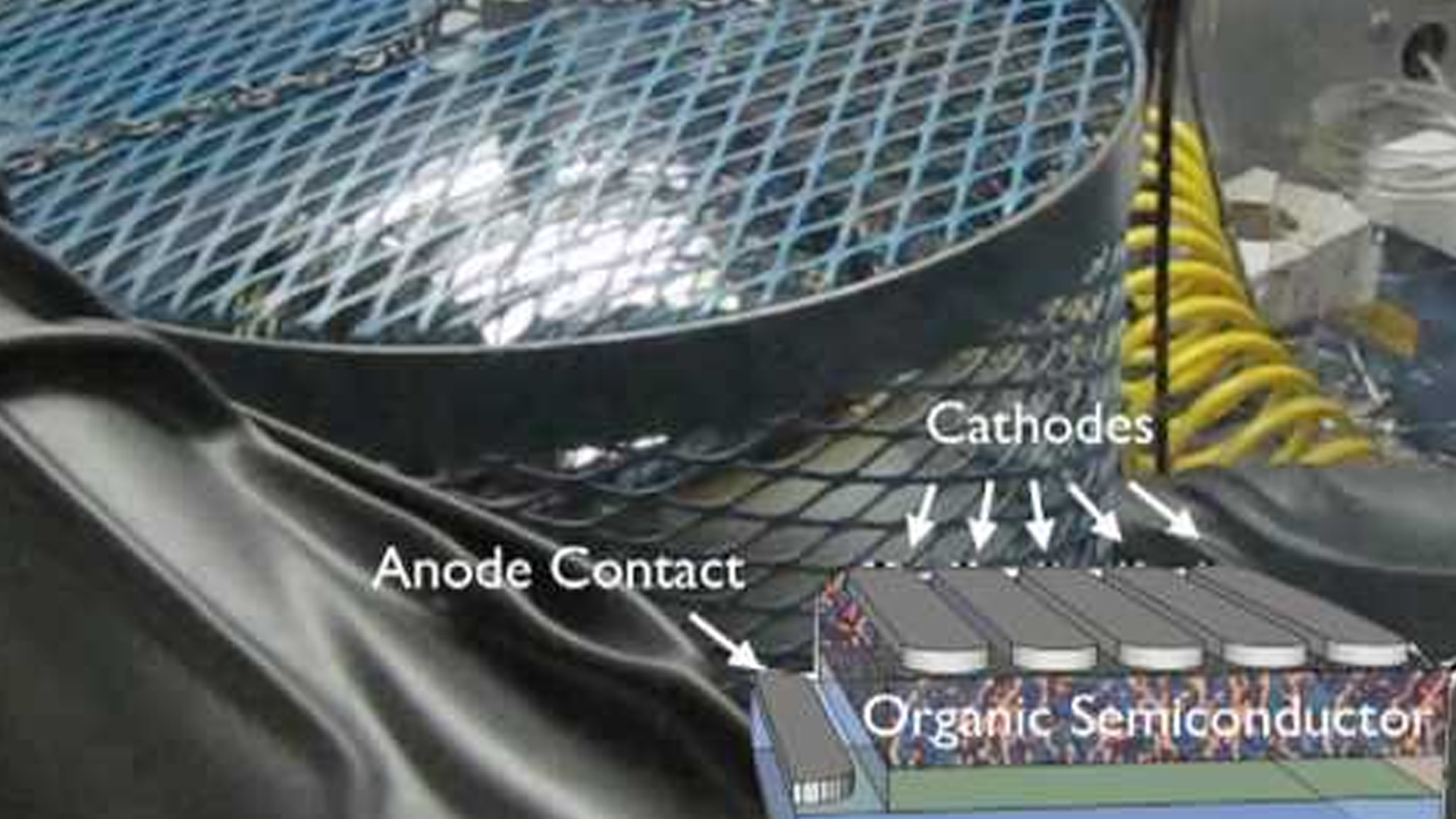

The fact that solar PV and wind are competing for the same incentive is a novelty of the upcoming auctions. However, in Italy, their levelized cost of energy (LCOE; the lifetime costs per energy production) is comparable. Therefore, we anticipate the two technologies can fairly bid for the same tariff, which represents an important step toward the achievement of the grid parity.

Plus, auction participants should find the amount of subsidies straightforward to forecast in Italy, compared to, for example, Spain. This is because under the Italian regulatory framework, unitary incentives remain fixed on a nominal basis, while Spanish subsidies are periodically reviewed based on a rate of return that includes interest rates and dynamic floor prices. We also flagged the risk that the latest renewable projects auctioned in Spain in 2016 and 2017 may not receive any subsidy and therefore be completely exposed to merchant risk (see "The End To Subsidies: The Beginning Of A New Era For Spanish Renewables?" published on Feb. 7, 2018).

Nevertheless, despite more predictable incentives than in other countries such as Spain, Italian renewables remain exposed to a certain authorization risk. There have been a number of cases in Italy where irregularities were found in plants' authorizations after some years of operation, and we understand that assets remain exposed to the risk of incentive revocation due to permitting or authorization irregularities at any time during the life of the project. Potential irregularities may expose the project not only to incentive revocation by the GSE but also to potential clawback, meaning the GSE may claim the reimbursement of all incentives already received by the project. To our knowledge, the GSE was not successful in pursuing such a reimbursement when a number of lawsuits were brought to court in 2017. Authorization risk remains difficult to assess by lenders and is based on due diligence carried out by legal advisers typically at financial close. We recognize the intention of the legislator to limit the amount of subsidies to be reimbursed in the range of 20%-80% of total incentives received. Still, this exposes single assets to high impact risk, which large portfolios can mitigate through geographical diversification.

Regarding limits to project security packages for lenders, we understand that the Third and Fourth Conto Energia, which granted feed-in tariff schemes to solar PV projects in 2011-2012, prohibit them from including any pledge over GSE receivables. This has not prevented banks from financing such projects. However, in our view, this may jeopardize the legal strength and isolation typical of project financings, unless strongly mitigated.

Banks have accepted these limits and continue to play a key role in financing greenfield and brownfield transactions in the Italian renewables market. A number of large refinancing transactions have closed over the past few years, mainly aiming at consolidating portfolios in a fragmented market. If, as a result, refinancing and acquisition opportunities start shrinking, will market participants or the regulator find the way to spur investments and achieve the 2030 renewable energy target?

Previous Incentive Mechanisms

Incentives for solar PV have traditionally taken the form of feed-in tariffs. Solar PV projects that successfully applied to Conto Energia schemes over 2008-2013 are entitled to receive a unitary tariff, fixed on a nominal basis over 20 years, on the energy produced (€360/MWh-€100/MWh, depending on the Conto Energia). Feed-in tariffs for these plants typically represent about 85% of total revenues as these assets are also entitled to sell the energy produced.

Renewable sources other than PV (mainly onshore wind) have already participated in competitive auctions, the last one of which launched in December 2016 (800MW). In that case, the amount of bids received was almost double the size auctioned and since almost all the bidders offered the maximum discount (40%, corresponding to €66/MWh), the final ranking was determined by considering the earliest authorizations received. That type of auction, however, was different to the one to be held in 2019 as those projects were entitled to retain all of the upside in case market prices rose higher than the strike price.

Renewable Energy Production In Italy

Although hydro remains the primary source of renewable electricity generation in Italy (13% of total gross electricity production in 2018), solar PV and wind increased their share to about 8% and 6%, respectively.