Global Solar Installations to Rise 20 Percent in 2014

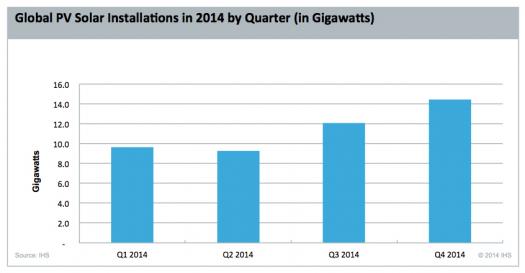

Global photovoltaic (PV) solar installations will rise to 45.4 gigawatts (GW) in 2014, with 32 percent of this total, or 14.4 GW, coming in the fourth quarter, according to IHS Technology .

Although IHS has trimmed its forecast for 2014 by 1.5 GW due to weaker-than-predicted performance in several key markets, a 20 percent increase is still forecast in installations from 37.8 GW in 2013.

Driven by strong demand in China and the United States, the final quarter of the year will again be the largest in terms of new installations. A total of 32 percent of annual installations will occur during the fourth quarter, as presented in the attached figure. IHS predicts that these two countries alone will account for more than half of all global demand in the final quarter of 2014.

"Following a first half that saw declines in several key countries, the global PV solar market is undergoing a major acceleration in the final quarter of the year," said Ash Sharma, senior director of solar research at IHS. "China and the United States will propel global growth. With China installing more than 5 GW and the United States installing 2.3 GW in the fourth quarter of 2014, these two countries will account for more than 50 percent of global installations during this period. The huge final quarter in China is expected to be only slightly higher than what was achieved in the same quarter of 2013"”a figure that surprised many in the industry."

A tale of two halves for solar

Several countries achieved strong installations in the first half of the year, including the United Kingdom and Japan. However, there were also declines in Europe and in countries that typically undertake more installations toward the end of the year. This set the stage for a major rebound in installations during the second half of the year. However, Germany and Italy will see another year of market decline with only 2.1 GW and 0.8 GW of new installations in 2014, respectively, down from 3.3 GW and 1.7 GW in 2013.

Second-half rebound for China and U.S.

Throughout 2014, IHS has expressed doubts over China's capability to meet the ambitious targets the government set for distributed PV (DPV) in 2014. After a recent adjustment from its government, the country's overall target of 13 GW is now in line with the IHS forecast.

However, IHS predicts that ground-mount PV will still dominate the market this year and account for 8.5 GW of installations. DPV is struggling to overcome barriers, including the lack of suitable rooftops and difficulties in obtaining financing.

Installations in the U.S. are forecast to follow a similar seasonal pattern in the final quarter. Installations have been ramping up throughout the year, and IHS predicts that 33 percent of U.S. installations in 2014 will be completed in the fourth quarter.

UK to become fourth largest PV market in 2014

Among the leading photovoltaic markets in 2014, the United Kingdom is experiencing the strongest percentage growth by far.

The country saw a huge boom in utility-scale installations in the first quarter as developers took advantage of the attractive renewable obligation certificates (ROC) scheme, which offered 1.4 ROC per megawatt-hour (MWh).

The U.K's massive growth in 2014 is in part an unintended consequence of the government's review and subsequent closure of the ROC scheme to PV projects above 5 MW in size. The resulting rush to beat the March 2015 deadline of the expiration of the scheme will lead to 3.1 GW of PV installations being completed in the fourth quarter of 2014 and the first quarter of 2015. IHS predicts that a significant portion of this will be completed in 2014 to avoid the bottleneck and delays in connections that were seen during an equivalent rush in February and March of this year.

In total, IHS forecasts 3.0 to 3.2 GW of new installations in 2014, making the United Kingdom the fourth largest market this year after China, Japan and the United States. IHS predicts that following a strong first quarter in 2015, in which more than 65 percent of annual installations in the U.K. will take place, utility-scale installations will fall, leaving residential and commercial rooftops as the main sectors.

Market growth to slow down in 2015, but to remain solid

Annual growth of global PV installations in 2013 and 2014 will be more than 20 percent as established markets have expanded rapidly. However, IHS is forecasting increases to slow to 16 percent with 53 GW of new capacity being installed.

China's market more than doubled in 2013 and is projected to grow by 30 percent in 2014. Unless new policy or targets are raised further, IHS predicts China's annual growth to slow to 10 percent in 2015"”but still sufficient for the country to remain the largest end market globally.

Meanwhile, installations in Japan are expected to peak in 2014 at 9.1 GW, before slightly declining in 2015 as land availability, grid connection issues and an upcoming feed-in tariff review take their toll on demand.

Emerging regional hot spots across the globe represent huge opportunities for growth, and IHS predicts such markets will steadily increase their share. However, development in these regions should not be overestimated, as policies are slow to be implemented and governments are keen to avoid the boom-bust scenarios seen in other markets

Information is derived from the Q3 2014 PV Demand Market Tracker from the Solar service at IHS.