Future remains bright for solar energy in the mid and long-term despite COVID-19

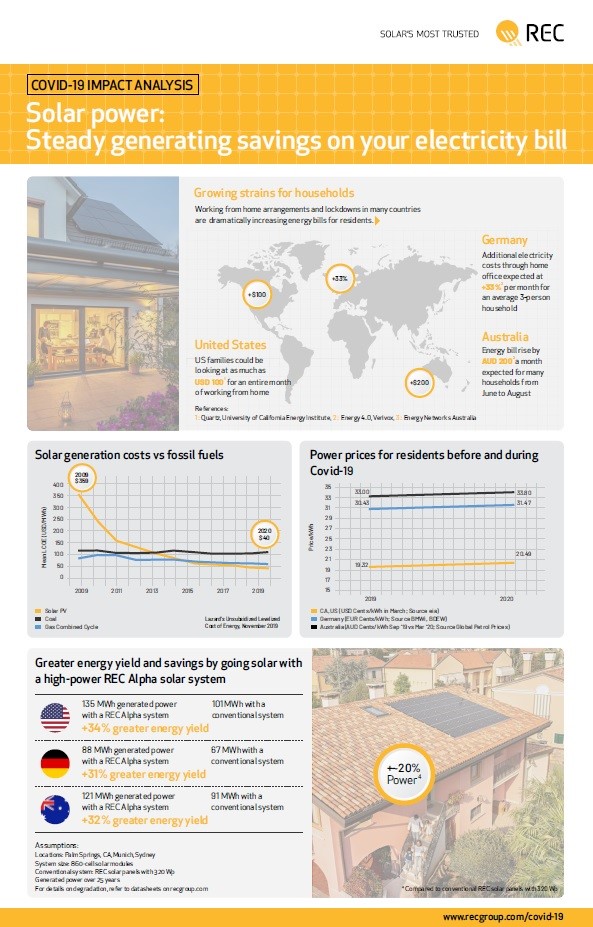

As society, people and businesses around the globe are confronted with an unprecedented global health crisis, the economic ramifications are increasingly tangible in various industries. The solar industry is no exception and is currently taking a hit resulting in supply and demand constraints as well as border closures and country lockdowns. However, market analysts at REC Group strongly believe that the solar industry is poised to come out of the crisis, potentially even stronger, in the medium and long term. There are various economic stimulus packages under way by governments all around the world, that are expected to include positive incentives for the solar and clean industry. This likely can be supplemented by significant investments into critical infrastructure in the fields of digitization, renewable electricity and e-mobility, which as the crisis has shown have gained importance. This will additionally enhance the growth of solar.

Solar energy has rapidly become more attractive financially, enabling increasing energy autonomy at highly competitive electricity production costs (LCOE). In addition, PV can be deployed more quickly than fossil fuel or nuclear plants and at any size. In challenging economic times like today, state incentives can additionally contribute to the robust economic outlook for solar deployment. All in all: the reasons to go solar have not changed due to the crisis. REC Group therefore remains optimistic that any disruption to the solar industry remains a temporary low and will not impact the bright mid- and long-term outlook.

The current estimated data on global demand for solar energy support our optimism. While the figures for 2020 have been revised with a more moderate trajectory to between 106 GW and 126 GW by REC analysts, global PV demand forecasts for 2021 are now between 124 GW and 140 GW. To put this in perspective, the total capacity of solar installations worldwide amounted to 115 GW in 2019.

Looking at the world regions where REC Group is most active, particularly noteworthy is the strong growth in utility scale solar in the USA. Overall, installations in 2020 are forecasted to see only a slight COVID-19 impact and a clear year-over-year growth to 17 GW compared to 13.3 GW in 2019. In the US residential market, we currently see an increased trend towards remote selling. Since soft costs represented 68% of total residential system prices, this additionally helps reduce residential system costs and enhance potentially solar’s stronger sustainable growth after COVID-19. Moreover, there are signs that 2021 could be a stronger year in the US than previously thought with estimates up to 22 GW of additional capacity installed in 2021.

REC Group moreover observes that the European residential installations in the first quarter continued to grow almost normally across the largest residential markets in central and northern Europe, including Germany and the Netherlands. In Germany, installers still have orders booked until May and June, but limited visibility after that. If mobility restrictions continue to be present at the same level, this PV segment could be the least impacted by COVID-19 in Europe. Overall, Europe’s solar market is expected to see a significant drop in 2020, but a strong recovery in 2021.

Australia was one of the few exceptions in terms of installation slowdown or halt – as this trend has not been observed so far. However, the most recent updates indicate that although there is no rush of order cancellations, there are significant declines in new customer enquiries due to the overall uncertainties in the economy and lockdowns. Once the lockdown is lifted, the residential segment, which constitutes the bulk of Australia’s rooftop solar market, is expected to see a quick rebound. For larger scale systems, financing might be postponed, with overall demand for 2020 expected to be reduced by 20%. Full recovery is expected by 2022 with 5 GW of installations, equivalent to forecasts made before COVID-19.

REC Group has created a dedicated information hub on COVID-19 to continuously provide insightful updates on how REC is managing the actual challenge, what to expect for the solar markets and how is COVID-19 impacting solar’s drivers.