Shifting market proves difficult for inverter companies

IMS Research forecasts 2013 to be another challenging year for photovoltaic (PV) inverter manufacturers, with flat revenue growth globally and a major shift away from traditional markets leading to a reshaping of the supplier base according to the company's latest report from. The top ten inverter manufacturers are likely to suffer because of falling inverter prices and because new markets such as Japan, China, India and the U.S. will prove difficult to penetrate and may not compensate for decreases in their core markets, Germany and Italy. Recent announcements of profit warnings, and Chapter 11 filings by leading suppliers SMA and Satcon highlight the challenging conditions being experienced by all PV inverter manufacturers at present and this may not improve until 2014.

According to the recently released quarterly update to World Market for PV Inverters report, IMS Research forecasts double-digit growth of PV installations with 35 GW of installations predicted in 2013. However, inverter revenues will remain flat as prices are forecast to decline in a highly competitive market as manufacturers attempt to break into new geographic markets and gain market share. A major geographic shift in demand, coupled with continued, intense price pressure will present a major challenge for the leading PV inverter suppliers in 2013.

Although the U.S. and some key Asian countries will more than make up for the shortfall left by the decreasing markets of Italy and Germany, these markets may not be easily accessible to many of the leading inverter suppliers and penetrating the markets will be challenging. Some of the key challenges that inverter manufacturers will continue to face in 2013 will be certification standards, lower cost bases and local manufacturing requirements, as well as intense competition from local suppliers. As some of the Asian countries have a much lower price point, one of the biggest hurdles for inverter manufacturers in 2013 is that they will not be able to subsidize their Asia operations by their profitable European business.

As FiT cuts have occurred in mature PV inverter markets such as Germany and Italy, manufacturers are increasingly looking to the growth markets of U.S. and Asia. "Manufacturers that can successfully penetrate these growing PV markets and will stand to reap the benefits in the future as the market develops "“ but this won't be easy," explained Cormac Gilligan, PV market analyst at IMS Research. "Longer term horizons and sound strategic decisions will be needed in the future years as PV inverter market becomes more fragmented due to the diverse geographical spread as more PV markets develop, including South Africa and South America."

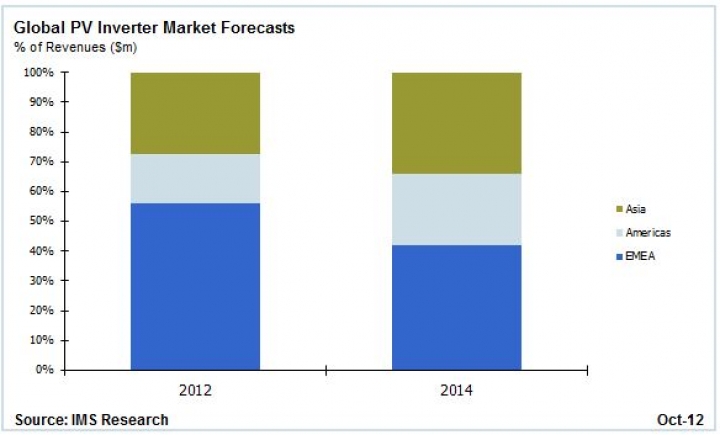

For those manufacturers that withstand the challenges of 2013 and successfully penetrate these emerging markets, the future years are forecast to return to double digit growth as the PV market reaches greater maturity. However the key inverter markets will no longer be centered in Europe but spread over a greater number of continents. IMS Research forecasts that Europe accounted 54 percent of global shipments in 2012, however this will fall significantly to 40 percent by 2014. As a result, IMS Research predicts that the top ten manufacturers in 2014 will be quite different to those seen today, with many more Chinese and Japanese companies.