News Article

Recapitalization of centrotherm passes decisive hurdle

centrotherm photovoltaics AG has passed the decisive hurdle for the company's reorganization and recapitalization: at the discussion and voting meeting that was convened by the Ulm District Court, creditors and shareholders approved the insolvency plan that was submitted with a large majority. With the confirmation by the court and the satisfaction of the final formal conditions, the insolvency proceedings can soon be terminated.

"With their decision, creditors and shareholders have allowed centrotherm to successfully complete its reorientation, thereby reopening the way to positive future prospects. If we implement the plan as envisaged, it will comprise an equally beneficial result for shareholders, employees and creditors. For shareholders, millions of euros' worth of value, the stock market listing and the value enhancement potentials of their shares remain. Creditors stand a good chance of realizing 100 percent of their receivables, or even more. Last, but not least, all of the currently approximately 1,000 jobs within the centrotherm Group can also be maintained," was how Tobias Hoefer, Management Board member responsible for the insolvency plan and the company's own administration, summarized the outcome.

The plan entails continuing the company as a listed stock corporation, and strengthening its capital structure through converting unsecured creditors' receivables into the company's shares. Creditors will cede 70 percent of their receivables deemed unconditional and without restriction to an independent administration company which is at liberty to dispose of such assets as it sees fit. This administration company will transfer the ceded receivables to centrotherm photovoltaics, thereby becoming a shareholder in the debtor. The transferred insolvency receivables will be cancelled. In other words, centrotherm photovoltaics AG will enjoy a significant reduction in its debt position. The administration company will acquire shares in the debtor as consideration for the receivables which have been transferred, a move which will occur as part of a combined capital reduction and increase.

In the first step, the company's share capital will be reduced by EUR 16,929,904 to EUR 4,232,476 by consolidating the shares in a five to one ratio (capital write-down). In a directly subsequent step, the share capital will be increased again to EUR 21,162,380 by way of a non-cash capital increase through transferring the creditor receivables (debt-to-equity swap).

As a consequence, the administration company will act as a kind of trustee by holding 80 percent of the shares for the creditors, with the residual 20 percent remaining with existing shareholders.

The administration company is obligated to the insolvency creditors to sell the shares on the best possible terms, settling their claims from the sale proceeds. Depending on the sale proceeds achieved, the insolvency creditors will potentially receive 100 percent or more satisfaction of their original insolvency receivables.

"Compared with alternative approaches, the insolvency plan offers advantages for all participants in the proceedings. In any case, no creditor or shareholder will be worse off than they would be if their assets were to be sold in a normal procedure," Hoefer emphasized.

The insolvency plan also includes a number of regulations which should ensure successful implementation as far as possible. These include that the satisfaction of the insolvency plan is supervised by court-appointed administrator Prof. Martin Hörmann. The creditor committee will also continue, monitoring the sale of the shares by the administration company, in particular.

"A settlement of interests as with this plan sets an example of how companies can be reorganized as intended and supported by legislators with the German Act Relating to the Further Simplification of the Reorganization of Companies (ESUG). As a consequence, we have needed only a few months to make a globally operating and listed group fit again for the future, achieving a fair settlement of interests in the process," was the assessment of administrator Prof. Martin Hörmann. "On this scale, it sets a unique precedent in Germany to date."

"This is the result of hard and committed work by management and staff, over recent months, since the insolvency protection proceedings were applied for in July 2012. We have proceeded very successfully with the strategic, structural and operational reorientation of the centrotherm Group, and better than expected given an ailing market for photovoltaic products," noted CEO Jan von Schuckmann. "The company enjoys secure medium-term financing, making it a reliable partner for both customers and suppliers. We have done our homework in a difficult sector environment.

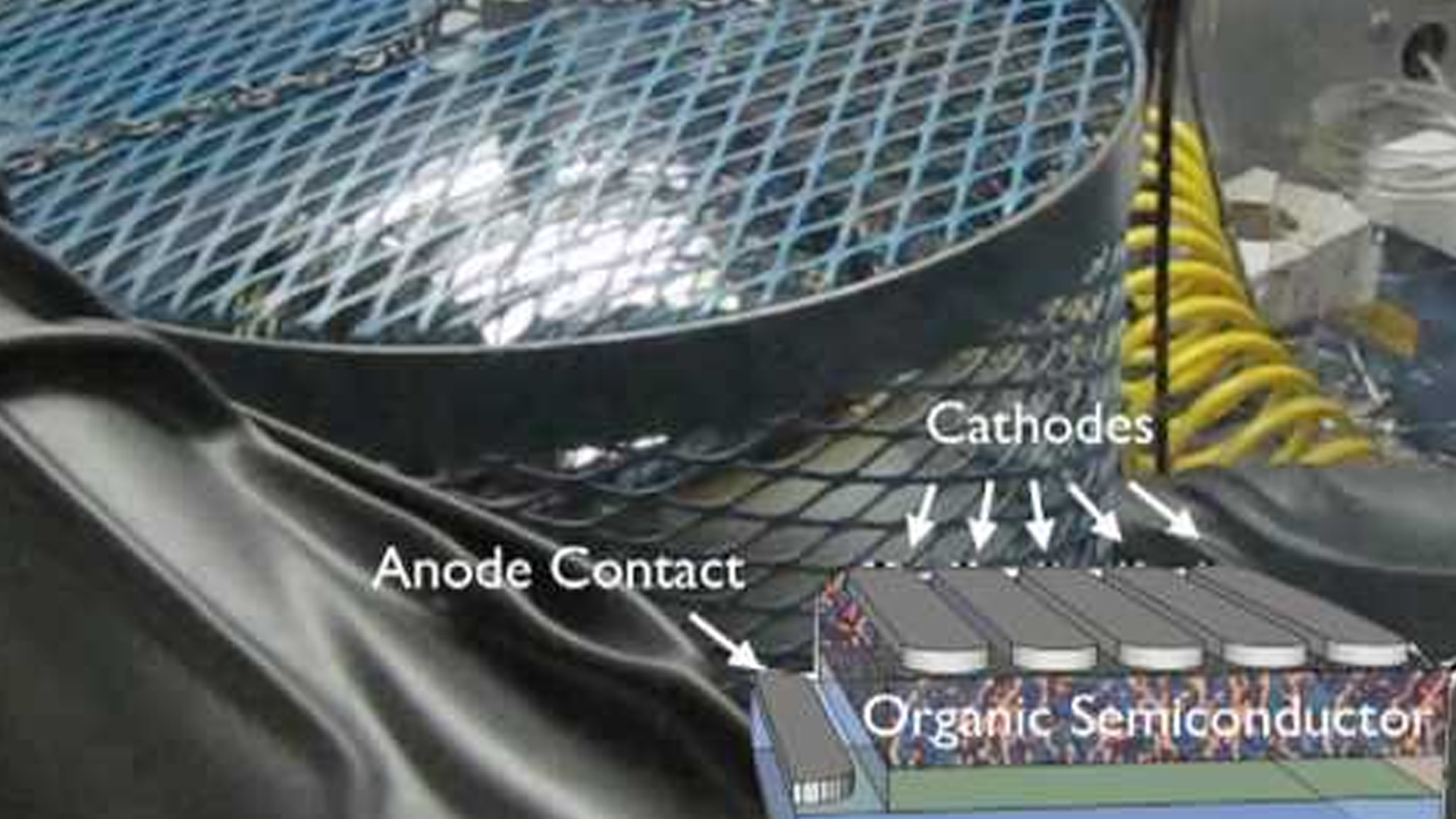

"The works council, which was established a few days ago with the support of the Management Board, also ensures the involvement of employees in the "new centrotherm" in the future. The centrotherm Group's new strategic orientation includes a concentration on its core business of production technology for thermal surface processes in the photovoltaic industry, with a focus on solar cells. As the second pillar, the semiconductors area, which offers a long-term sales revenue potential of EUR 100 million to EUR 150 million, is to be further established and expanded. Here, centrotherm already enjoys an established market position with competitive products.

The Group structure has also been significantly more streamlined, concentrating centrotherm photovoltaics AG's competences at its Blaubeuren site. "We have become more efficient and powerful in all areas, thereby creating good preconditions for our fresh start. Our employees' expertise is our most valuable asset," von Schuckmann notes.

The changes at Management Board level which have already been announced also become effective with the approval of the insolvency plan at the end of January.

Dr. Dirk Stenkamp, who, as COO of centrotherm photovoltaics AG, has been responsible to date for the Operations area and the major project in Qatar, will leave the company to devote him self to new professional challenges.

Dr. Peter Fath will step down from centrotherm photovoltaics' Management Board as of January 31, 2013. Dr. Fath, who has been CTO to date, will remain attached to the company in another function with his technology expertise and excellent network of contacts at international research institutions, and will continue to support and drive ahead with activities in the MENA region and with contractual negotiations at the large-scale project in Algeria, among other activities.

Dr. Riegler, who has been centrotherm photovoltaics AG's CFO to date, will continue to act as a consultant to the company until the successful conclusion of important restructuring projects such as the preparation of the debt-to-equity swap, the optimization of internal processes and the SAP rollout.