News Article

Solarbuzz: New Solar Capital Expenditure Cycle to Start in 2015

Capital expenditures for equipment suppliers serving the solar photovoltaic (PV) manufacturing sector are forecast to enter a new upturn phase beginning in 2015.

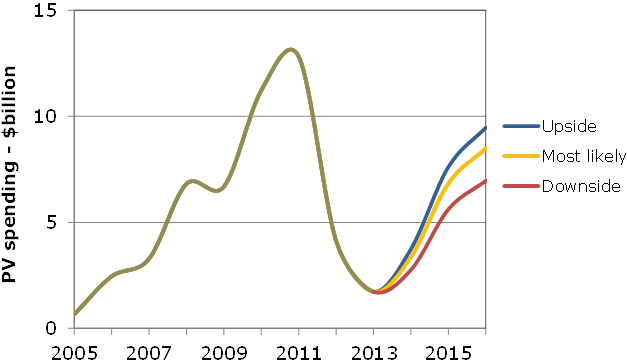

According to new research in the latest NPD Solarbuzz PV Equipment Quarterly, PV equipment spending could potentially reach $10 billion in revenues in 2017.

"During 2012 and 2013, solar PV equipment suppliers were confronted by the sharpest downturn ever to hit the sector," according to Finlay Colville, vice president at NPD Solarbuzz. "The decline was caused by strong over-capacity that reshaped the entire PV industry in 2012, which resulted in manufacturers' capital expenditure budgets being put on hold during 2013."

For 2013, PV equipment spending"”covering tool revenues from crystalline silicon (c-Si) makers of ingots, wafers, cells, modules, and thin-film panels"”declined to an eight-year low of $1.73 billion. This drop contrasts sharply with the previous cyclical peak of approximately $13 billion in 2011.

With capital expenditures largely frozen in 2013, PV equipment suppliers recorded less than $1 billion of net bookings last year, keeping the PV book-to-bill ratio well below parity. In the absence of new PV orders, many equipment suppliers were forced to restructure internal PV business units and focus on other technology sectors.

Over the next six months, however, end-market solar PV demand will catch up with the 45 GW of effective capacity within the industry, and this will mark the official end of the two-year downturn in capital expenditure. Thereafter, plans will quickly emerge from PV manufacturers for new capacity additions, which will ultimately drive a strong rebound in revenues available to the equipment supply chain.

The first peak in PV capital expenditures, covering the period from 2008 to 2011, provided $38 billion of equipment revenues; however, these revenues were spread across several hundred PV manufacturers and a range of different PV technologies. The next major growth phase for PV equipment suppliers, beginning in 2015, will be driven mainly by leading tier-one PV manufacturers across each stage of the PV value chain.

Furthermore, future PV manufacturing capacity additions are expected to occur in increments of 1 GW or more. Initially, these additions will be motivated by economy-of-scale benefits in cost reduction and productivity. Thereafter, technology-driven spending, historically of minimal upside revenue potential to PV equipment suppliers, will gradually be phased in, as PV cell efficiencies approaching 20 percent become the industry standard.

With c-Si based solar PV modules retaining a market share above 90 percent, new capacity expansions from c-Si PV manufacturers will dominate the PV equipment spending upturn beginning in 2015; however, the competing thin-film segment will continue to offer revenue potential for the equipment supply chain.

"Strong investments from new thin-film challengers are expected in the coming years, including Hanergy's plan for several gigawatts of new CIGS capacity within China," added Colville. "New thin-film capacity is also likely to be built in the Middle East and Latin America, as emerging regions seek to enter the PV manufacturing arena and differentiate themselves from crystalline silicon products made in Asia."