News Article

The inverter market tipped to reach $45 billion in 2012 and $71 billion by 2020

Yole Développement announced its Inverter market trends for 2013 "“ 2020 and technology changes report. Yole Développement's report provides a focus on the six most attractive applications (PV, wind turbines, EV/HEV, rail traction, motor drives and UPS) and a new analysis on power stack trend from the previous report. Yole Développement also updated the technology trends, market forecasts until 2020, supply chain analysis and regional players strategies and comprehensive understanding of dynamics for passive components and semiconductor devices.

There is significant growth in the inverter market, which reached $45 billion in 2012 for motion and conversion

Energy related topics have become more and more important in 2012 "“ vehicle electrification, renewable energies, electricity transportation, "“ and as a direct result, the power electronics market has increased. This growth is driven by:

"¢ High volume and cost pressure applications such as EV/HEV

"¢ High added-value markets like renewable energies and rail traction

In this Yole Développement report, the analyst updates and presents market forecasts until 2020. "We estimate the inverter market to be $45 billion in 2012 and to reach $71 billion by 2020. A totalof more than 28 million units were shipped in 2012 and we estimate that will grow to 80 million units in 2020," explains Brice Le Gouic, Activity Leader, Power Electronics at Yole Développement.

Thus, the main components of inverter, passive and semiconductor modules (that we will find in power stacks) represent enticing industries. The power module market was $1.9 billion in 2012 and passive components achieved a market size of more than $4 billion, including capacitors, resistors, connectors, busbars and - newly added in this updated report - magnetic components (inductors and transformers).

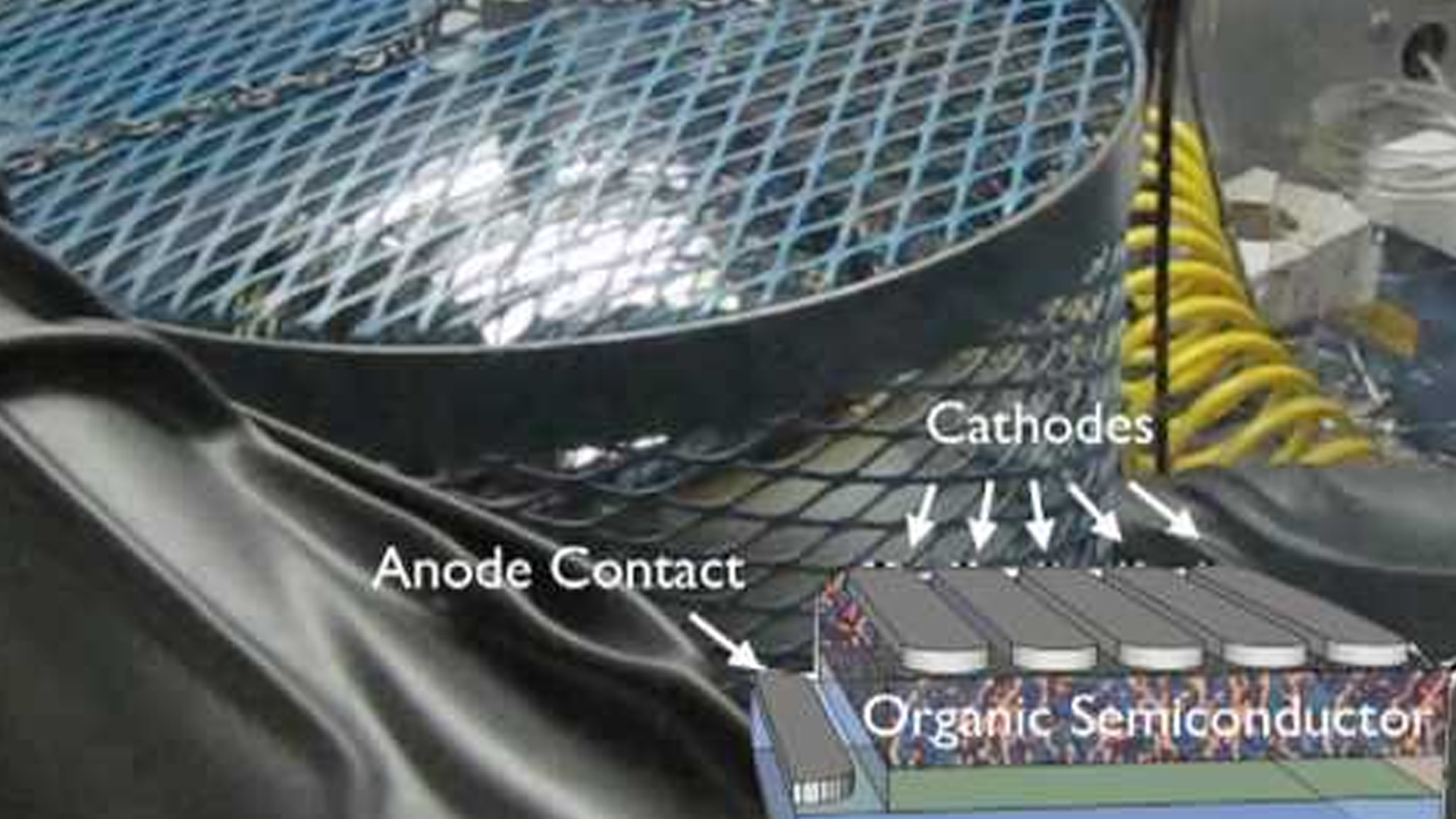

As expected, wide band gap semiconductor devices have also started to penetrate those high-end market segments: SiC is present in PV inverters "“ a total market size of $43 million primarily driven by diodes in micro-inverters, but also by JFETs "“ and GaN which should be introduced in 2013.

Semiconductor technological developments continue to evolve and sharpen inverter performance

Yole Développement 2012 investigation confirmed that semiconductor improvements enabled more efficient conversion, lighter systems and more reliable end-products. IGBTs have improved (higher current density, thinner and faster), as have SiC and GaN-based devices. GaN could be delayed in its market introduction, but SiC is already here and several companies showed SiC power module capabilities all last year. In this report, Yole Développement updated its technology roadmaps for materials and devices.

Adoption of power stack is driving the modular approach across applications

This report also highlights the power stack trend that Yole Développement surveyed closely in 2012!

The Power Stack is the custom design and manufacturing of an inverter's sub-unit which includes only the core components: power semiconductor module, cooling system, capacitors, resistors, current sensors, busbars and connectors "¦

Power Stack is the innovative sub-system of an inverter. Inverter and device makers are becoming power stack manufacturers for several reasons:

"¢ Vertical integration

"¢ Access to several applications, since power stacks are less application-dependent than inverters

"¢ Internal cost reductions

"¢ Access to high-end markets

"¢ Sustain R&D in-house

Large firms such as Ingeteam, Semikron or ABB are now involved, but power stack also interests smaller players such as AgileSwitch "“ former IGBT driver manufacturer "“ who are part of this about $500 million market.

Major changes are happening across the supply chain

Power electronics often requires having several types of knowledge and experience gained know-how in mechanics, electronics, semiconductors, electrics, fluidics and hydraulics, and connectors. Therefore, development can be complicated and final products expensive.

As a consequence, Yole Développement analyst has observed and analyzed in this report two main trends coming out of the power electronics industry:

"¢ Japanese and Chinese players, especially system makers, tend toward internal vertical integration and master the manufacturing processes of each sub-system and component. In the case of Japanese companies, this tendency is mostly driven by cost reduction and absorption of intermediary margins, whereas Chinese companies want to access the technology and show some proof of quality.

"¢ On the other hand, EU and US players are diversified and acquisition of new or complementary competencies (such as Mersen, Rogers or Power Integration) or high-end R&D and prototyping services (APEI, Primes, IMEC, GE Global Research) is becoming more common.