UK policy changes tackled at finance conference

The UK solar industry gathered yesterday for the first time since the Government announcement of a proposed review of solar subsidies for large scale PV. The Solar UK Conference on Finance and Investment was held in London and a strong line up of speakers moved the industry tone of indignation towards the more pragmatic requirements of dealing with upcoming changes.

Concerns about the Department of Energy & Climate Change (DECC) announcement were evident but, without the emotive response that has been prevalent in recent reports, were more focused on the details that were available and the potential response the industry could make. Almost every speaker had adjusted their talk to reflect the announcements that the Renewable Obligations (RO) would not continue for some sectors of the solar offerings.

The scene was set by Solar UK's Editor in Chief, David Ridsdale who pointed out that although the proposed industry changes demonstrate how volatile the solar industry can be, the fundamentals remained to make the UK one of the most desirable places in Europe for solar investors. The government interference would continue as long as the industry relied on subsidies to stimulate growth. He also pointed out that the negative emotional reaction that was fed through media channels following the announcement had more potential to detract investors than the announcement itself.

The first speaker of the day was a revelation to many. Despite industry complaints that the big energy companies can be hard to approach at times, Nick Williams, Power Originator at Centrica, gave a welcomed talk on the the UK utility market. In a refreshingly candid talk, Williams pointed out that the large energy companies have been so used to distributing energy that they are still coming to terms with the new requirements of receiving energy as well. Williams provided a clear guide to understanding power price market, ROCs, Levy Exemption Certificates (LECs), Power Purchase Agreements (PPAs). Acknowledging that change will continue to happen and impact industry players, Williams discussed how Centrica was open and ready to communicate with the solar industry. He clarified that the company is willing and able to guide companies (small or large) through the changing minefield of energy production at a time of great change for the industry.

The next speaker was lawyer, Neil Budd from SGH Martineau who provide an overview of investment opportunities under Contract for Difference (CfD) trade structures. As Budd pointed out in his quiet but knowledgeable fashion, the timing of his presentation was more appropriate than when he began. Budd provided a clear outline of what the DECC review is suggesting in terms of change and then described the CfD process in tendering for support funds that may not be realised. With companies having to supply an auction bid, they never know whether they will be undercut. Issues such as transparency of process have not being announced and are the sort of issues that should be raised through the consultation process. He pointed out that comparable wind technologies were not required to move to CfD until 2017 and did not feel they were likely to even apply for the first round, providing some lead time for solar, as that technology competed well against other comparable technologies.

Finlay Colville from NPD SolarBuzz then gave the audience an overview of the current market and the possible outcomes of the change in policy. Colville's main issue with the proposed changes were the fact that the decisions were not being based on accurate industry data. Ofgem is the preferred data source for DECC and Colville rightly pointed out that due to the collection process can often be six months out of date. Pointing out the rooftop commercial was one of the smallest sectors for the UK, he questioned the rationale of the decision beyond a political choice and wondered what the goal truly was. Colville pointed out that the Government is stating the ground mounted sector grew too fast but questioned what where the parameters of such a decision and why the industry does not push for parameter settings and a clear long term energy policy.

Two of the UK's largest installers Lightsource and Conergy provided an excellent overviews of ground mount solar installations as well as the expected response to the review.

Nick Boyle of Lightsource was the first to point out the new proposals were designed to assist the big players as the review document was 800 pages long ensuring SMEs would not have the man power to digest such a dense tome let alone respond to it in any meaningful way. He admitted this suited his company but was clear in his concern that the potential impact on the sector would have ramifications for all companies. He suggested that smaller players should consider at least aligning with a larger player as complexities to gain projects increase.

Boyle also lamented the Government not having the correct information citing a lack of understanding of the difference between a GW of installed solar and a GW of installed wind. He also pointed out that in the long run CfDs will be a better mechanism, if you get one, as it will have a longer agreed price and plan. The concern is that companies may not be willing to take the risk in spending the capital to even apply for one.

Robert Goss of Conergy pointed out that none of the changes prevent ground mounted solar from going ahead and felt that companies would still find ways to continue to grow despite policy changes. He pointed out that his company has discovered that a more important factor of success of ground-mounted arrays was to involve the local community at the earliest point and gain their support. Goss also pointed out that the changes included a boost for community based arrays and despite councils being more canny in bargaining skills, there was positive opportunity for companies prepared to develop community based products. Both Goss and Boyle agreed that there was little the industry could do to change the review process but encouraged companies to provide input to gain clarity and more defined parameters.

The afternoon sessions focused on commercial rooftops with speakers covering finance, planning, building and risk evaluation. The strong line up of presenters provided a clear understanding of the pros and cons of moving towards commercial rooftop development. Graeme Seeley of Asset Finance and Management explained some of the restrictions in funding assets and suggested the industry needs to develop a more flexible approach to funding mechanisms to increase market capture. Schools are not allowed to borrow money so require a leasing arrangement to participate. He pointed out that banks are slowly returning to invest in the sector after a period of uncertainty based more on their own troubles.

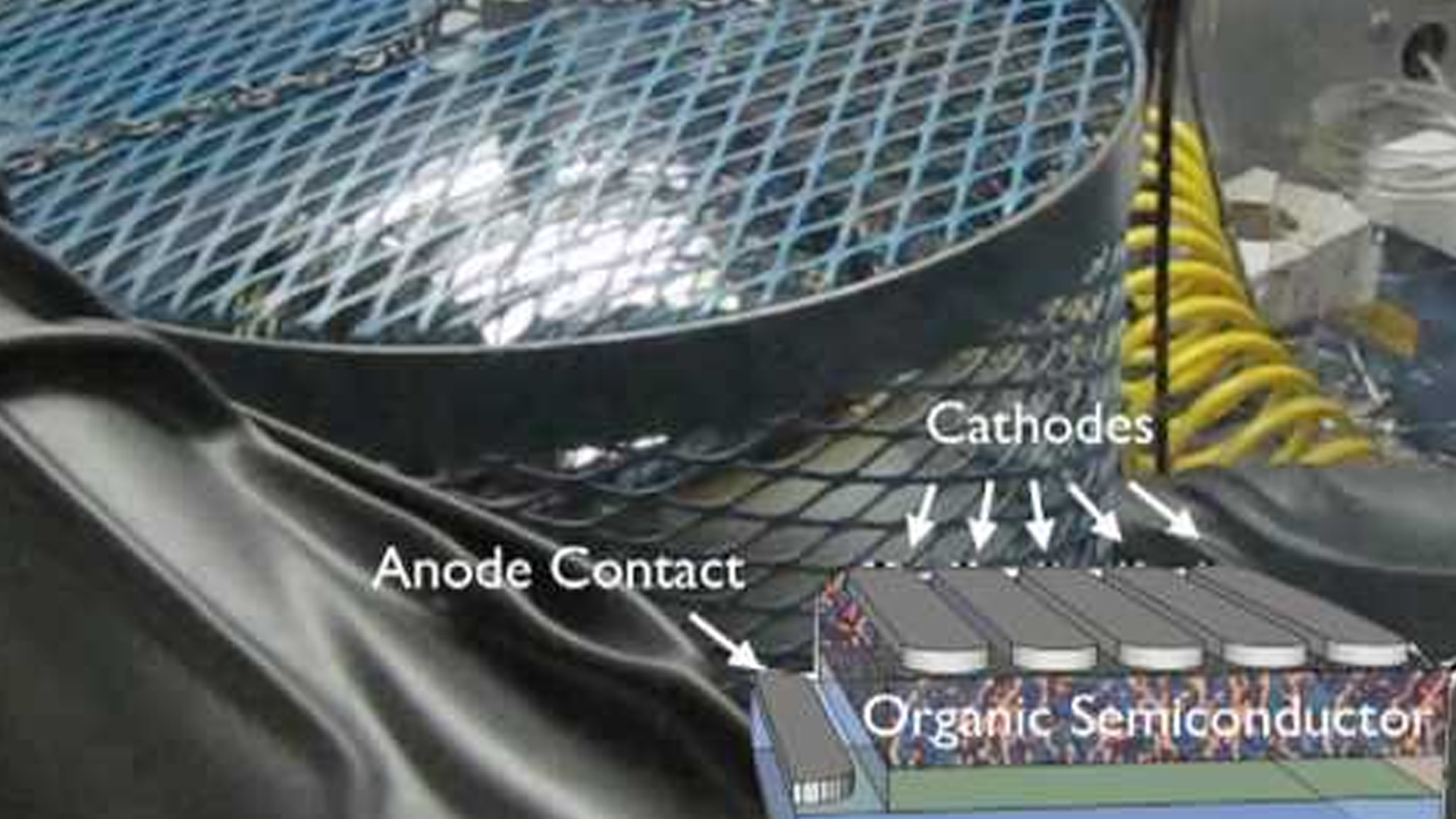

Nick Keeler of Hanergy gave a spirited talk that outlined installation practices and pit falls that companies need to deal with in the commercial roof space. Keeler discussed how the industry is moving towards grid parity and the faster it achieves this then the quicker such policy changes will impact. He pointed out that the rooftop market in the UK was about 40% weight constrained so questioned whether such factors were taken to account.

OST Energy co-founder Oliver Soper presented information based on consulting for over 1 billion pounds worth of projects and provided clear guidelines to the different risks and assessment requirements in planning a project. Some of the risks were heightened by policy change but often complexity in contract development came from the number of players involved and their previous experience. With many partners sometimes involved it is vital to have positive communication. Especially for time sensitive projects.

Howard Johns of Southern Solar commented that the Government was planning to revitalise the rooftop market regardless. He felt that the political aspect to the DECC review amounted to little more than a tip to Telegraph readers raising voices about visual blights and lamented that such decisions could not be made on industry realities. Johns discussed how large scale rooftops can provide excellent returns with as little as a four year payback if self purchased. He iterated the need to develop good links with all parties and a roof top deal can involve tenants, landlords, installers, councils, investors, etc. All requiring their own information and all with the power to slow a deal down by the simple act of delaying signing.

Kingspan Energys' General Counsel, Alex Cooke provided the conference with the most specific actions companies and industry can take in responding to the review. After demonstrating the importance of roof structure and stating that companies should not install any roof PV if there is a doubt the roof will not last as long. He pointed out the industry needs to maintain best practices upfront and at all times, especially when there is potential for backlash.

Cooke made some positive suggestions on how people could influence the policy review process reminding people it was a chance to reduce red tape. Cooke questioned the Government's plan to require planning permission for projects above 50kWp and wondered why this should not be increased up to 1MW within the Solar Strategy programme. He felt the lack of consistency across LPAs and DNOs was something to be addressed and can be in the review process.

Cooke felt there were unnecessary delays in G59 testing and felt pressure needs to be applied to Ofgem re DNO plans and that the slow Q&A process with Ofgem must be improved. He suggested the industry work closer to ensure all Ofgem to be raised are done at the same time and remain sensible and consistent to avoid added confusion. He believes there must be greater accountability and ownership by individuals within Ofgem possibly by allocating account managers. Cooke also took aim at the complex multi stage application processes that often have up to 70 questions per application. He felt that there were a number of tweaks that industry could push for that enabled the government to continue with their plans and allow realistic moving space for the industry and reminded people they can respond before July 7th direct to DECC at SolarPV.Consultation@decc.gsi.gov.uk. Cooke felt it was a rare chance to help sweep red tape and barriers aside.

Louise Shaw of Ernst and Young led a panel of the speakers on rooftop applications and provided an outline of the impressive growth solar has been through. Asking if there were enough 5MW projects to pick up the slack, the panel pointed out that excessive 5MW projects would likely see the Government react again. With risk averse public organisations there may be less uptake than imagined. The industry was in danger of forgetting how political energy was and the other players involved. Any campaign from the industry needs to be election based and positive. All agreed that negative knee jerk reactions can cause more harm than good and with public support high the situation truly is in the industry's favour.

Even with all the changes there are still growing market sectors so the final two speakers spoke on the growth in residential markets and community based projects. Leigh Goodman of Goldfield Partners looked at finance options in developing residential portfolios and saw great potential for companies to build up a strong portfolio that can then be sold off rather than sitting on the merits.

Industry veteran Phillip Wolfe ended the programme with a positive message of potential growth with the community-based projects. With exemption from the CfD move and a doubling of FiTs they become the only investor based large scale ground mounted projects left. He outlined the complexities but convinced of a growing opportunity not to be missed.

The mood by the end was a more positive one with plans being made to tackle the realities of a changing landscape. The over riding message was that despite any challenge the entrepreneurial nature of the UK solar market would once again win through and surprise the Government by beating the poor expectations imposed.

To be involved in the update on the industry 20GW by 2020 contact Jackie Cannon jackie.cannon@angelbc.com